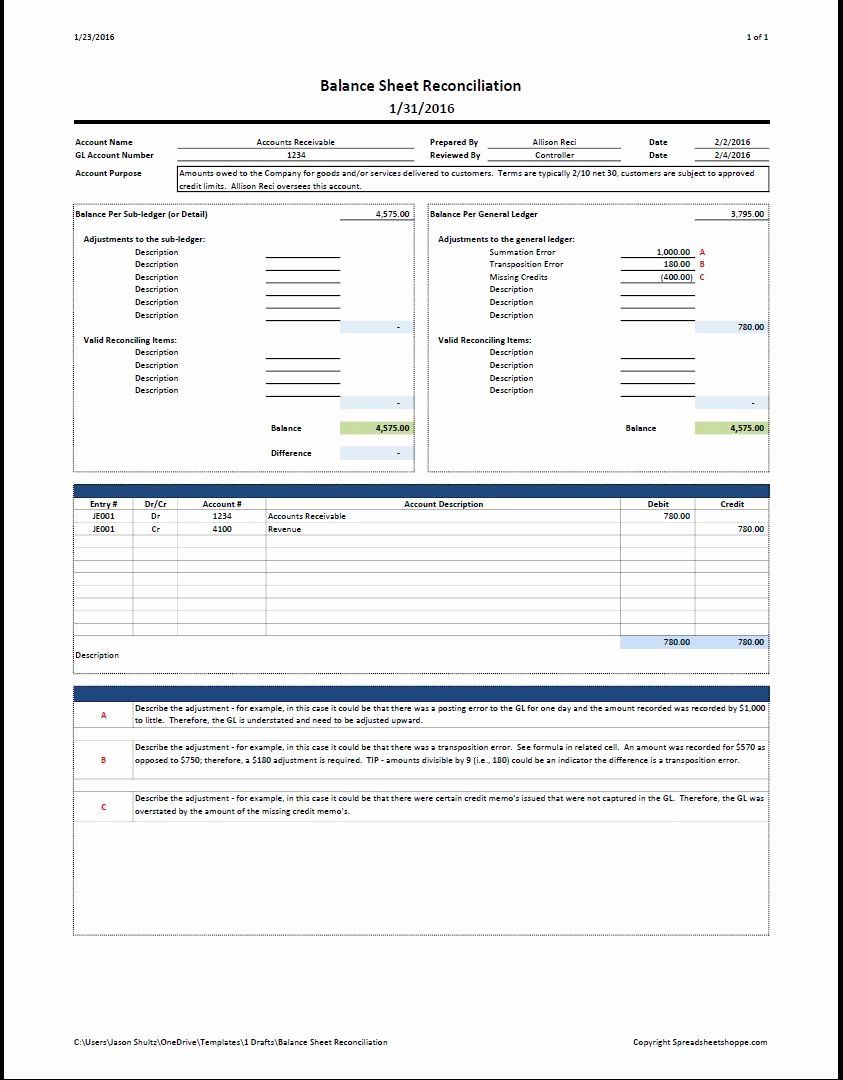

What are Balance Sheet Reconciliations. Going account by account and making sure your source documentation andor listing or account contents matches the account balance.

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Personal Financial Statement

Reconciling Balance Sheet Accounts Balance sheets are summaries of your businesss financial account balances income and expenditures.

Reconciling balance sheet account. When a company reconciles its bank statement it is reconciling the balance in its general ledger account Cash or Cash. GL balance sheet accounts should be reconciled on a timely and periodic basis to verify that the items are accurately posted to the account or not. Reconciling this account tells you whether the business still has the computers vehicles machinery and so on that it thinks it does.

Updated July 12 2021 0842. If you cant locate the assets listed on the balance sheet there may be issues with theft or poor reporting and you may be overpaying taxes. See Procedure 1101 PR04 Section 2.

Enter the balance from your bank statement or subledger along with the general ledger balance and adjust amounts based on outstanding deposits and checks. Balance sheet reconciliations are a vitally important part of a companys financial reporting process. Reconciling your balance sheet lets you verify that all of your entries are recorded and classified correctly.

The funds within the GL balance sheet must be integrated in the reconciliation process unless prior arrangements have been made. There are a number of control accounts on the balance sheet which will often be subject to a reconciliation or audit. Understand Balance Sheet Account Balance Reconciliation and Attestation Roles and Responsibilities.

It is vital for a business to perform GL balance sheet reconciliation. Balance Sheet account balance reconciliations are different than expenditure reconciliations. Some Balance Sheet accounts must be reconciled and reviewed monthly.

Reconciling balance sheet control accounts. Balance sheet reconciliation is the process of ensuring your balance sheet information is accurate. Prior to issuing a companys financial statements it is wise to reconcile every balance sheet account by.

To do a reconciliation youll need to write down the ending balance from your account statement then add the amount of the deposits that have not cleared still. This reconciled balance must agree with the amount in your register. The balance sheet reconciliation process includes cross-checking balances and entries with documentation eg bank statements.

Businesses can also use it for reconciling balance sheet accounts such as accounts payable by editing the template to show the appropriate account information. Balance Sheet Reconciliation is the reconciliation of the closing balances of all the accounts of the company that forms part of the companys balance sheet in order to ensure that the entries passed to derive the closing balances are recorded and classified properly so that balances in the balance sheet. Learn more at.

They provide support and evidence that the numbers are accurate. Reconciliation Responsibilities Units are responsible for ensuring that balance sheet ledger accounts for which they are accountable for are reconciled monthly and in a timely manner. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained.

Reconciling the bank statement to the cash account balance reconciling the AR and AP subledgers to the AR and AP account balances identifying all items sitting in prepaid expenses maybe rolling forward fixed assets and accumulated depreciation. Reconciling an account is an accounting process that is used to ensure that the transactions in a companys financial records are consistent with independent third party reports. Reconciliation confirms that the recorded sum leaving an account corresponds to the amount thats been spent and that the two accounts are balanced at the end of the reporting period.

The checkbox you are talking about Reconciliation Account activates the Reconciliation Functionality in the Chart of Accounts. The key elements of balance sheet reconciliation. Reconciliations should not be prepared by the individual who reviews and approves the reconciliation.

They serve as a snapshot of your companys financial health and are often part of the financial package given to investors and boards of directors. The answer is with balance sheet reconciliations. Reconciling an account is likely to mean proving or documenting that an account balance is correct.

Balance sheets are stated as of a particular date and if the control is effective then users should understand account. Subtract the amount of all withdrawals that were not on the statement. They are done at regular intervals and are a part of routine accounting procedures.

Reconciliation option in the General Ledger Account allows you to see the current balance and the balance that will be after posting the transaction. Balance sheet reconciliation verifies the accuracy of the balance sheet by comparing the numbers on the general ledger to other forms of documentation to explain any discrepancies. Examples of Reconciling an Account.

FMS designates the reconciliation frequency for account balances that must be reconciled and reviewed outside the quarterly review cycle. Essentially reconciliation is done to verify that accounting for a certain period has been accurately portrayed on a companys books. Properly reconciling a balance sheet account involves making sure you have recorded and accounted for every transaction in your business and applied the proper classification in the process.

This guide will help to explain how to use Brightpearl reports to view the relevant data in order to audit each control account. A Balance Sheet account balance reconciliation is the comparison of one or more asset or liability balances on the Statement of Financial Position also known as the Balance Sheet to another source of financial data such as a Bank Statement a Subledger or another system. Checking Account with the banks information.

A balance sheet ledger account reconciliation is a key control over financial reporting at Yale.