Balance Sheet Reconciliation is the reconciliation of the closing balances of all the accounts of the company that forms part of the companys balance sheet in order to ensure that the entries passed to derive the closing balances are recorded and classified properly so that balances in the balance sheet are. In some accounting software such as QuickBooks both reports are generated from the same source.

Bank Statement Reconciliation Template Inspirational Blank Bank Statement Template Portablegasgrillw Statement Template Spreadsheet Template Worksheet Template

The key elements of balance sheet reconciliation.

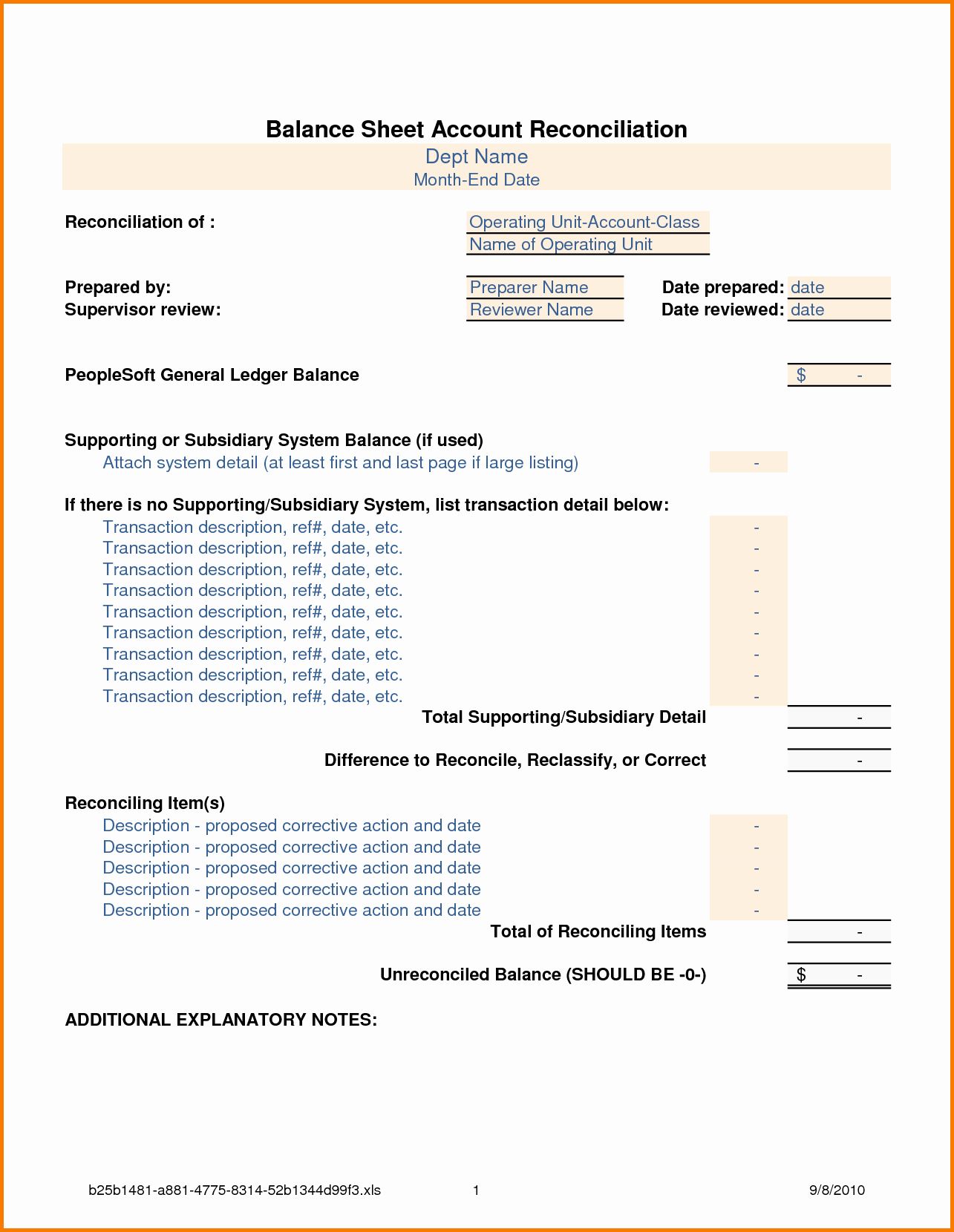

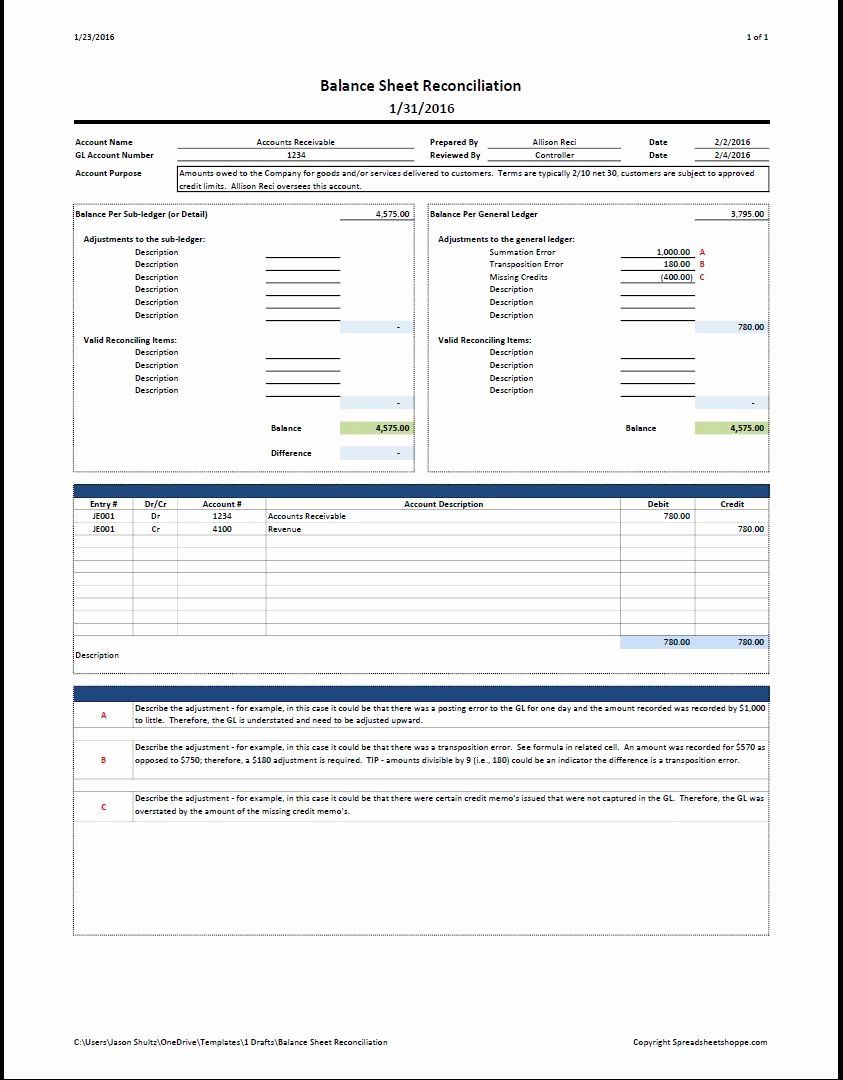

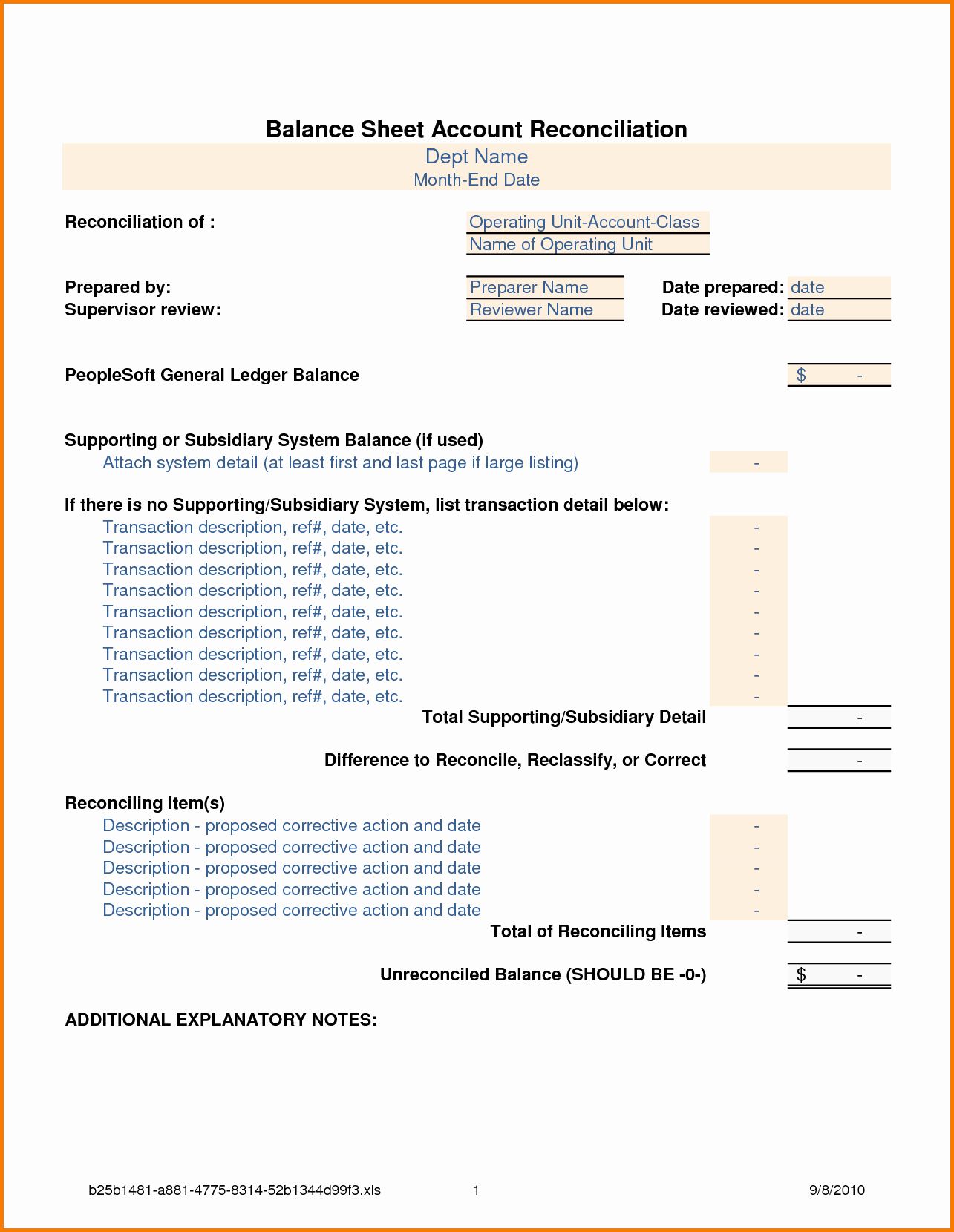

Reconcile balance sheet account. Reconciliations should not be prepared by the individual who reviews and approves. Enter the balance from your bank statement or subledger along with the general ledger balance and adjust amounts based on outstanding deposits and checks. This is called an accounts payable reconciliation.

What is a Balance Sheet Reconciliation. Prior to issuing a companys financial statements it is wise to reconcile every balance sheet account by collecting the information that supports the accounts ending balances. They are supposed to be the same if not there will be something wrong with any balance.

FMS designates the reconciliation frequency for account balances that must be reconciled and reviewed outside the quarterly review cycle. Reconciling your balance sheet lets you verify that all of your entries are recorded and classified correctly. Understand Balance Sheet Account Balance Reconciliation and Attestation Roles and Responsibilities.

Balance sheet reconciliations are a vitally important part of a companys financial reporting process. Balance sheet reconciliation is the process of ensuring your balance sheet information is accurate. However accountants still require to reconcile in.

In every business balance sheet reconciliation takes place in defined intervals be it monthly quarterly yearly etc. Another example is reconciling the balance in the general ledger account Utilities Payable. The accounts payable reconciliation process encompasses the steps noted below.

Doing so ensures that the amount of accounts payable reported in the balance sheet is correct. Properly reconciling a balance sheet account involves making sure you have recorded and accounted for every transaction in your business and applied the proper classification in the process. They are done at regular intervals and are a part of routine accounting procedures.

When I have been asked this question I have taught User to create Accounts Schedules for the accounts to reconcile. Reconciling your fixed asset accounts means checking that the total value in your balance sheet agrees to the register. The components of the balance sheet are given below.

Why Do We Need to Reconcile Accounts Payable. The golden rule is if its in your balance sheet you need to reconcile it to something. Reconciliation option in the General Ledger Account allows you to see the current balance and the balance that will be after posting the transaction.

This reconciliation process can be a difficult one when it is being performed for the first time. Balance Sheet Account Reconciliation Responsibility Matrix Activity Preparer Approver Ensure all transactions from the GL and subledger are entered Identify balance sheet accounts to be reconciled and source documentationsystem to reconcile against Review the account balance from the general ledger with source. Account reconciliation relies on large organisation and the upkeep of invoices account balances balance sheet reconciliation and more.

In the process of balance sheet reconciliation the components of balance sheet such as fixed assets current assets current liabilities etc. However this may be done simply to verify that transactions were recorded in the correct account. Businesses can also use it for reconciling balance sheet accounts such as accounts payable by editing the template to show the appropriate account information.

An account reconciliation is usually done for all asset liability and equity accounts since their account balances may continue on for many years. The balance sheet reconciliation process includes cross-checking balances and entries with documentation eg bank statements. Balance sheet reconciliation verifies the accuracy of the balance sheet by comparing the numbers on the general ledger to other forms of documentation to explain any discrepancies.

Essentially reconciliation is done to verify that accounting for a certain period has been accurately portrayed on a companys books. Are verified to ensure that the posting of entries into respective ledger accounts are accurately done. It is less common to reconcile a revenue or expense account since the account balances are flushed out at the end of each fiscal year.

Balance sheets list assets and liabilities and every transaction must be categorised as one or the other. They provide support and evidence that the numbers are accurate. Beyond these you will probably have some very business specific control accounts.

This way they can see the Account and Detail. Balance sheets are stated as of a particular date and if the control is effective then users should understand account composition by that date. When we have two balances balance sheets and accounts payable aging reports we need to reconcile both of them.

For example the Accounts Receivable balance could begin by comparing the balance with an aging of the accounts receivable. When accountants close the books they complete reconciliations of the balance sheet accounts. Balance sheet reconciliations add quite a bit of control without a lot of additional time or personnel costs giving this basic procedure the proverbial more bang for your buck over many other.

A Balance Sheet account balance reconciliation is the comparison of one or more asset or liability balances on the Statement of Financial Position also known as the Balance Sheet to another source of financial data such as a Bank Statement a Subledger or another system. Balance Sheet account balance reconciliations are different than expenditure reconciliations. Some Balance Sheet accounts must be reconciled and reviewed monthly.

Balance Sheet Reconciliation Template Elegant Balance Sheet Reconciliation Template Spreadshe Balance Sheet Reconciliation Balance Sheet Template Balance Sheet

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Personal Financial Statement

Balance Sheet Reconciliation Template Luxury Balance Sheet Reconciliation Template Balance Sheet Reconciliation Balance Sheet Reconciliation

Balance Sheet Reconciliation Template Fresh 18 Balance Sheet Templet Balance Sheet Template Balance Sheet Reconciliation Balance Sheet