Employers liability insurance is a legal requirement under the Employers Liability Act 1969. This policy must cover bodily injury or disease suffered by employees arising out of or in the course of employment in Great Britain.

Insurance And Liability Fact Sheet

The first premium and all renewal premiums.

Employers liability insurance doc. Employers liability insurance covers full-time and part-time employees any self-employed contractors you hire temporary staff apprentices volunteers and people taking part in work experience or training schemes. It shows the level of cover and the details of the insurer. Employers liability insurance can pay the compensation amount and legal costs if an employee or an ex-employee claims compensation for a work-related illness or injury.

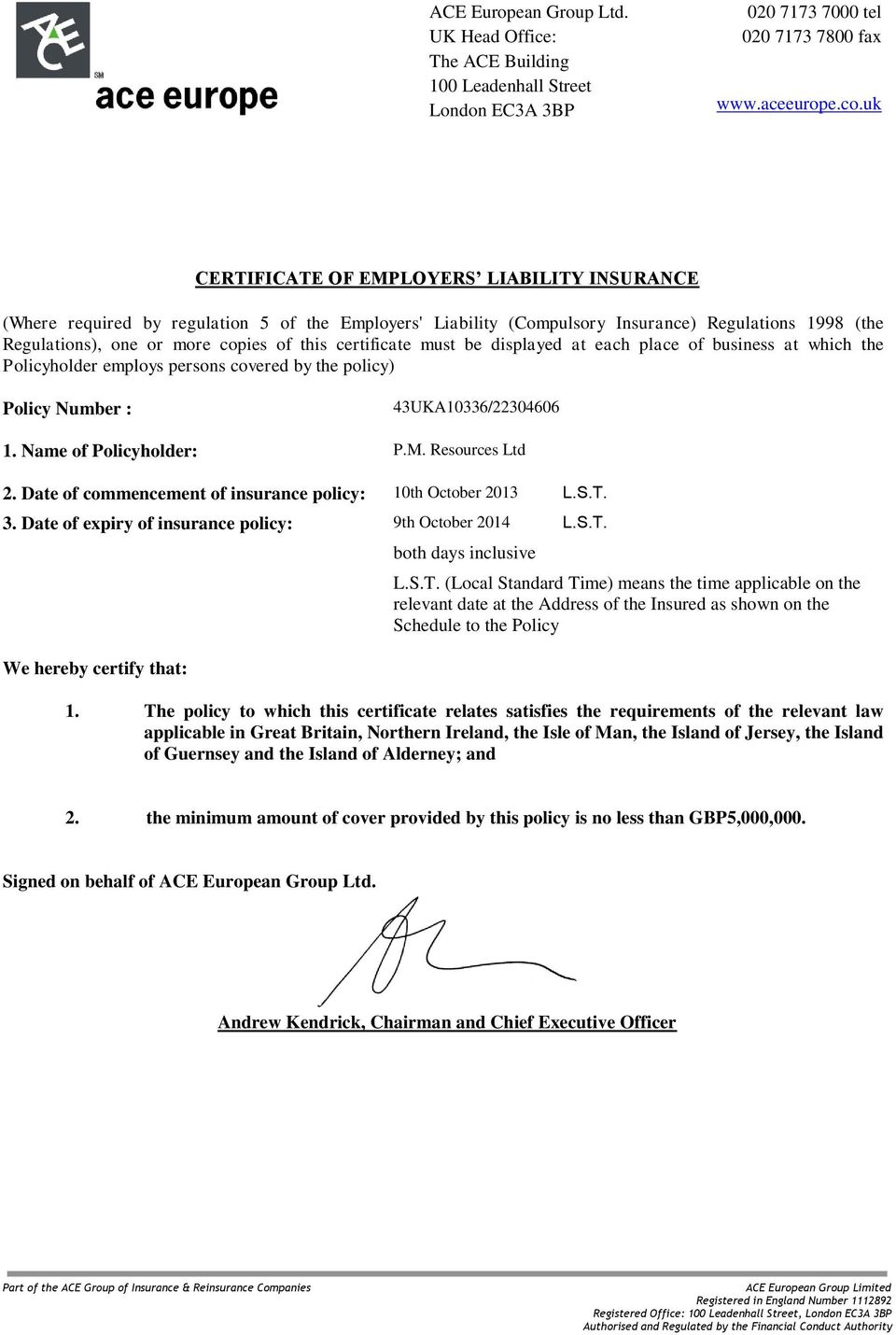

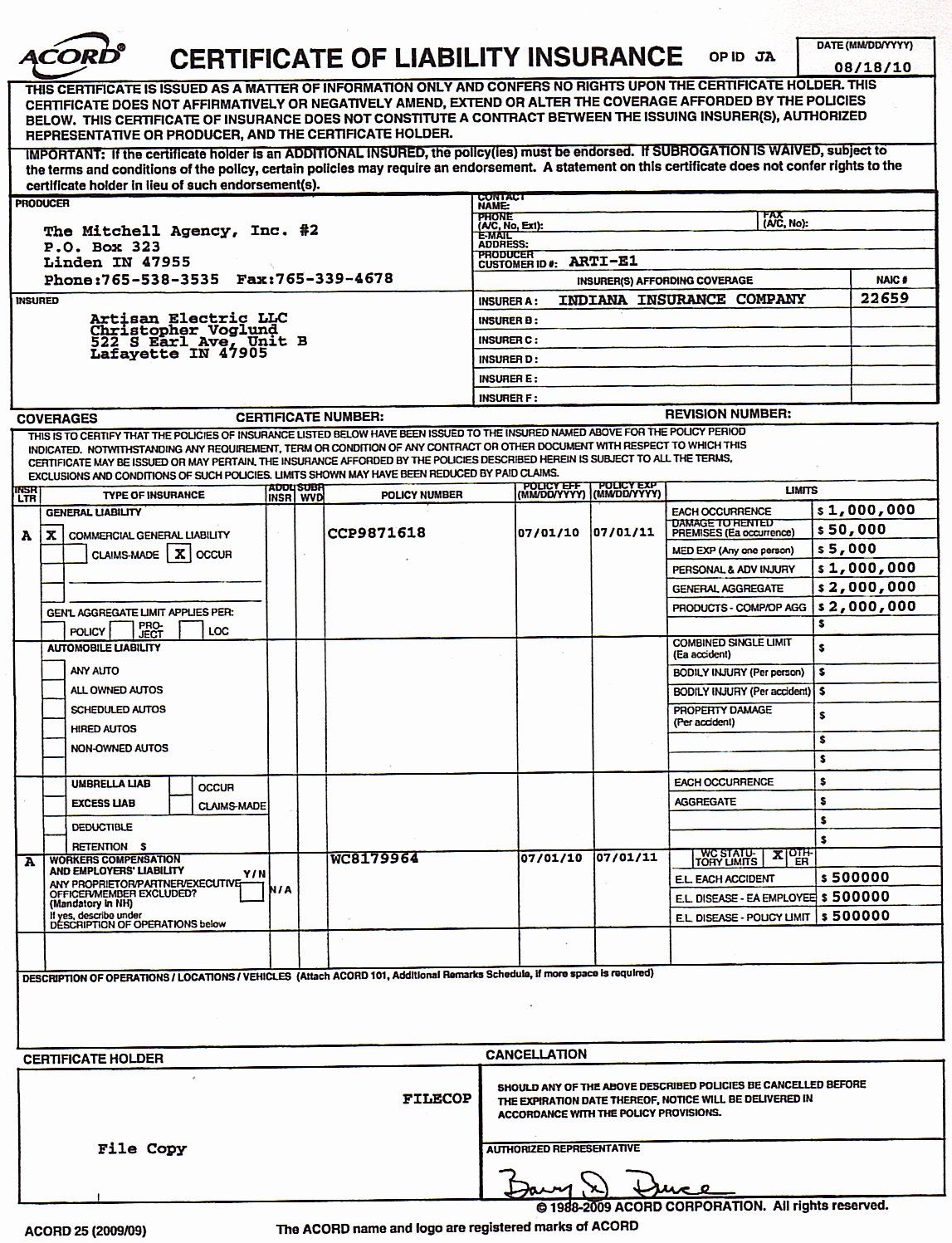

An employers liability certificate is a document that is provided by your insurer when you take out a policy to prove that your business holds valid employers liability insurance. Certificate of Employers Liability Insurancea Where required by regulation 5 of the Employers Liability Compulsory Insurance Regulations 1998 the Regulations one or more copies of this certificate must be displayed at each place of business at which the policy holder employs persons covered by the policy Policy No. CERTIFICATE OF LIABILITY INSURANCEDATE MMDDYYYY MonthDateYear.

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. Installations or associated structures your employer must have employers liability insurance to compensate you if you are injured at work or you become ill as a result of your employment with. Guide to the Employers Liability Act.

It outlines the details of your policy including what level of cover you have. The insurance must be sufficient to cover 2000000 for claims by any. An overview of the compulsory employers liability insurance regime.

To access this resource sign up for a free trial of Practical Law. Its there to protect your employees if they get injured or become ill as a result of working for your business. A cover level of 5 million of employers liability insurance is the legal requirement for most businesses although there are certain exemptions.

Employers Liability Compulsory Insurance Act 1969 ensures that you have at least a minimum level of insurance cover against any such claims. A certificate of employers liability or employers liability insurance certificate is a document issued by the insurer to attest that your business company has already had such an employers liability insurance. If at the time any claim arise under this Policy there be any other insurance covering the same liability the Company shall not be liable to pay or contribute more than its rateable proportion of any such claim and costs and expenses in connection therewith.

Employers are legally obliged to display this certificate so that all employees can see it. The Employers Liability Compulsory Insurance Act 1969 makes employers liability insurance compulsory for every employer in the UK for bodily injury and disease sustained by employees. Displaying evidence of this cover is a legal requirement for all UK employers.

Insurnce AgentBroker City State Zip Code. An employers liability insurance certificate is a document from your insurer that shows your company has employers liability insurance. Employers liability insurance provides coverage for the legal obligation of an employer to pay damages because of bodily injury by accident or disease including resulting death sustained by an employee.

The Employers Liability Compulsory Insurance Regulations 1998 are discussed as are common conditions and. EMPLOYERS LIABILITY INSURANCE – LIABILITY FOR TRANSFERRED EMPLOYEES Martin v Lancashire County Council February 1999 unreported. Employers Liability Insurance.

If your business has at least one employee you probably need employers liability insurance. Coverage Employers Liability Stop Gap We will pay all sums that the insured becomes legally obligated to pay as damage because of bodily injury or occupational disease to any employee of the insured who sustains an injury which arises out of and in the course of employment provided such employee. Employers liability insurance is a legal requirement for businesses of any size which employ staff.

What is Employers Liability Insurance. Employers Liability Insurance is a means of protection that focuses on the employees working a in a company. The Employers Liability Compulsory Insurance Act 1969 makes it compulsory for most employers carrying on business in Great Britain to have EL insurance.

Insurnce AgentBroker Street Address or PO. Employer may incur legal liability to an employee who sustains bodily injury or illness which arises out of and in the course of his or her employment. Workers compensation insurance workers comp insurancebee Employers liability office insurance business insurance small business insurance Created Date 4152011 40919 PM.

You must get Employers Liability EL insurance as soon as you become an employer – your policy must cover you for at least 5 million and come from an authorised insurer. Certifications Document Library Resources. The policy can cover the legal defence costs in the event of an allegation of negligence against you and where you are at fault.

This kind of insurance assures employers that there will be no financial loss on their part if ever an employee experienced a job related injury. How to display your employers liability insurance certificate. It covers the damages compensation costs and legal fees that a current or ex-employee is entitled to as a result of illness or injury.

Subcontractors do not need to be covered by an insureds employers liability policy. This note also identifies key issues affecting this type of cover such as claims arising from long-tail diseases and the rights of third parties against insurers. Employers liability insurance will enable you to.

Contact Phone Number. Employers Liability Policy Document. Most employers are required to have at least 5 million of employers liability cover or face a fine of up.

You shall become legally liable to pay as a result of any direct employee including any temporary or part-time employee of yours sustaining personal injury arising out of or in the course of their employment and which is notified to us during the period of insurance stated in. It will also pay the cost of compensation should an employee suffer an injury or illness as a result of work they. Employers liability coverage applies only if the injury or death of an employee arises out of and in the course of employment and is sustained.

The employer must take out an approved policy of employers liability insurance with an appropriate insurer.

Certificate Of Employers Liability Insurance Pdf Free Download

Browse Our Sample Of Liability Insurance Certificate Template Liability Insurance Insurance Printable Certificate Templates

Car Insurance Certificate Template Fresh Liability Insurance Liability Insurance Template Dannybarran Certificate Templates Car Insurance Liability Insurance

Acord Certificate Of Liability Insurance Form 25 Form With Regard To Acord Insurance Certificate Templates Best Templates Certificate Of Achievement Template