When the pointer changes to a 2-headed arrow drag down to add more rows. Most of the time an analyst will have to build a supporting schedule that outlines interest and debt when they are building a financial model in Excel.

Printable Excel Construction Schedule Template Schedule Template Schedule Templates Business Template

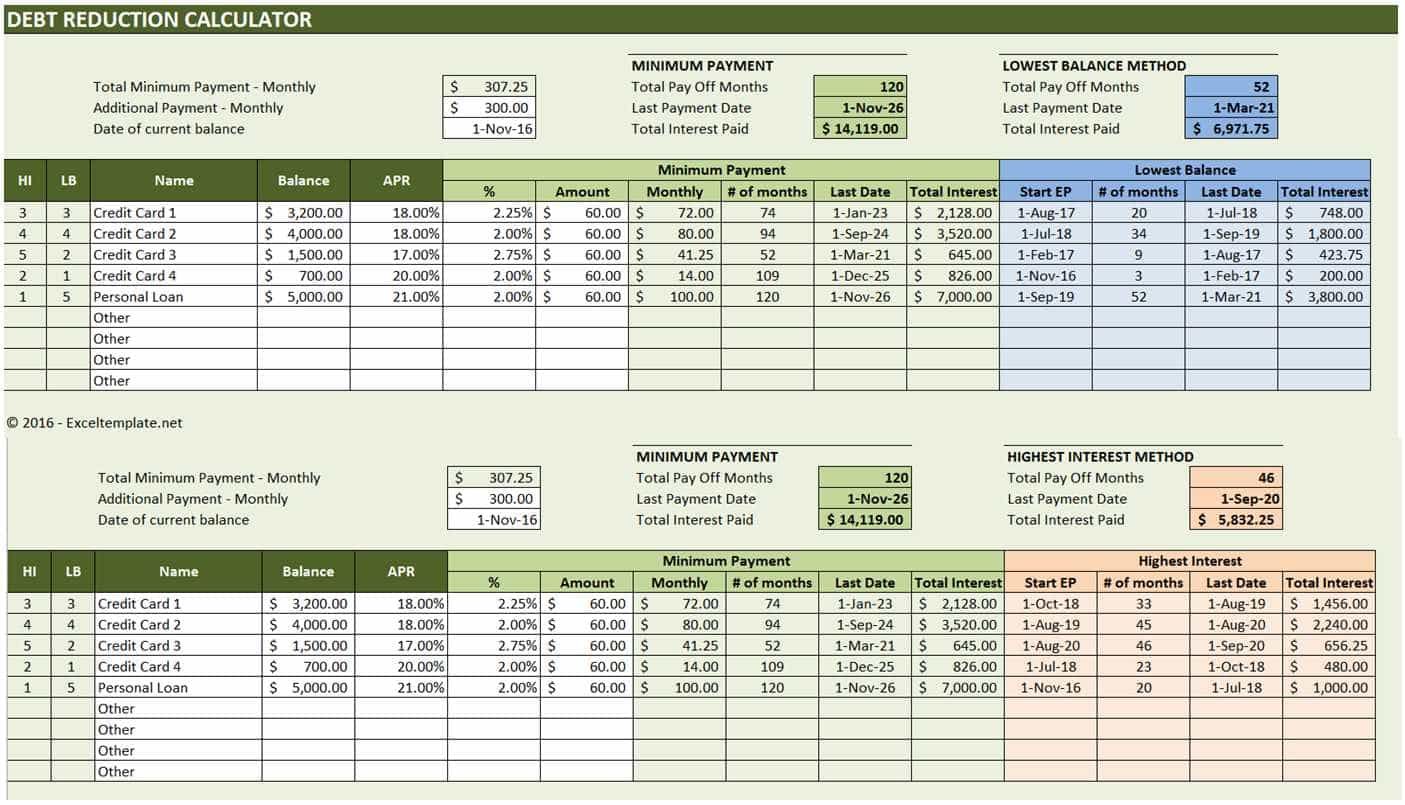

This is a debt schedule calculation template.

Debt schedule excel template. Simple to use and available to download immediately this debt schedule will help to track payments over a number of years. Point to the small handle at the bottom left corner of the table. Whether your company is borrowing money as a way of funding a project or it is used.

This video demonstrates an incredibly efficient way of using Excel to schedule your debt. Once you have downloaded this free and easy to use template you can get started right away. Debt Schedule – Excel Model Template – Eloquens.

You will need to have an idea of how much money you will set aside each month toward paying off credit cards and other debt to activate the debt snowball features of the spreadsheet. Constant payment constant amortization and balloon repayment. A debt schedule is made up of-Opening balance.

This debt schedule is fully customizable in Excel. Our model uses a conservative approach of. It can be anything such as credit cards educational loans carauto loan or home mortgage loans.

Loan Payment Schedule Table Columns. Download free debt payoff trackers for Excel and PDF Updated 8182021 When working on paying off debt you can use all the help you can get. Components of a Debt Schedule in a Financial Model.

Simple to use and available to download immediately this debt schedule will help to track payments over a number of years. To make a top-notch loan amortization schedule in no time make use of Excels inbuilt templates. Total must agree with balance shown on Interim Balance Sheet The schedule should include loans for contractsnotes payable and lines of credit.

Scroll to the end of the loan payment schedule table. Then we can use the PMT formula to calculate the total payment for the first period PMTB27B26B25. 9 Debt Snowball Excel Templates.

Debt Reduction Calculator is a ready-to-use excel template that helps you calculate your total debt and helps you design a payoff plan for debt reduction. The Financial Model Template uses the following Excel formulas. The snowball debt means to pay off one debt at time with all the cash you have until the cash is fully paid off and the move to the next debt and repeat it so that the full cash may pay off.

Giving you automated calculations based on your input figures Ezra shows how you can document and schedule your bank loan debts quickly and efficiently. Open the template in our feature-rich online editing tool by hitting Get form. If you need more rows than that follow these steps.

Simple to use and available to download immediately this debt schedule will help to track payments over a number of years. A few handy Excel formulas will help you calculate and model debt financing. Try a financial template calculator in Excel to help pay off a.

Insert the relevant date. Debt Schedule – Excel Model Template – Eloquens. How to Use the Business Debt Schedule Template.

A professional excel tool which can be integrated into your financial model or used to make quick estimates for the cost of a loan. This is a ready-to-use debt schedule Excel template to help you to record interest payments and debt over a period of time. – annuity amortization or custom debt repayment scheme.

Business Debt Schedule CREDITOR NameAddress Original Date Original Amount Term or Maturity Date Present Balance Interest Rate Monthly Payment Collateral or Security WHAT WAS LOAN FOR. This is a ready-to-use debt schedule Excel template to help you to record interest payments and debt over a period of time. Usually many of us are trapped in debt.

Useful Excel Formulas to Model Debt Funding. By building a debt schedule a business will be able to make strategic decisions on whether to pay off debt acquire new debt or. Debt is nothing but borrowing from your future salary.

In the Excel Loan Payment Schedule Template the table has 48 rows. If it is easier for you you can use this spreadsheet monthly. It can be anything such as credit cards educational loans carauto loan or home mortgage loans.

The following tips will help you fill in Debt Schedule Template Excel quickly and easily. Thats how you create a loan or mortgage amortization schedule in Excel. The opening balance in our debt schedule is equal to the loan amount of 5 million so in cell E29 we enter B25 to link it to the assumption input.

Amortization schedule Excel template. This module allows calculating a schedule of principal and interest debt payments with high customization. A debt schedule template is a tool that lays out all of the debt a business has which helps to review assess and visualize the debts.

9 Debt Snowball Excel Templates – Excel Templates. Fill out the requested fields that are colored in yellow. Although it may seem like a little thing you can get a very real motivational boost from tracking your debt payoff goal using worksheets and charts.

The debt schedule is a supporting schedule and it is one of the schedules that ties together the three financial statements. A financial template is a great resource to generate a monthly budget track spending and manage your debt. You will be able to build a detailed model to schedule how much debt your business will take on.

They match an organizations staffing needs with employee availability. Debt interest excel spreadsheet principal schedule annuity amortization grace period repayment. Go to the e-autograph tool to add an electronic signature to the template.

Just go to File New type amortization schedule in the search box and pick the template you like for example this one with extra payments. Commonly the debts are paid at their minimum rate until the extreme need of a credit card to be. – monthly quarterly semiannual or annual payment schedule.

Usually many of us are trapped in debt. Debt schedule assumptions income statement balance sheet cash flow statement ppe dcf. Present value formula allows you to calculate the debt level you can raise given projected cash flows.

Whether your company is borrowing money as a way of funding a project or it is used. Simply enter the amount you have planned for paying down the debt and the spreadsheet will tell you what portion of that amount should be applied to the bill with the highest interest rate. During the initial setup you want to include your company name and the date.

Hit the arrow with the inscription Next to jump from field to field. Debt Reduction Calculator is a ready-to-use excel template that helps you calculate your total debt and helps you design a payoff plan for debt reduction. Debt Schedule Template Excel Schedule Template debt roll forward schedule template excel debt management plan template excel free debt schedule template excel An employee schedule template is a great way to get a head start on making employee schedules for organizations above a certain size and staff strength.

This is a ready-to-use debt schedule Excel template to help you to record interest payments and debt over a period of time. The template includes calculations for multiple kinds of the mortgages.

Bill Payment Spreadsheet Excel Templates Spreadsheet Template Debt Reduction Paying Off Credit Cards

Excel Bill Tracker Excel Spreadsheets Templates Spreadsheet Template Bill Tracker

New Project Time Tracking Excel Template Exceltemplate Xls Xlstemplate Xlsformat Excelformat Micr Spreadsheet Template Excel Templates Timesheet Template

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy In 2021 Balance Sheet Accounting Basics Excel Spreadsheets Templates